In 1974, the Employee Retirement and Income Security Act (ERISA) became law and ushered in the tax-qualified savings plan (also known as the IRA, 401(k), Keogh, and others). Almost overnight, Wall Street advisors lost their biggest and best clients—pension fund managers and workers were cast into the unknown world of managing their own investment accounts.

Wall Street shifted its model to serve the small individual investor by ramping up the fledgling mutual fund industry. Prior to 1974, there were a mere 360 mutual funds with total assets of about $48 billion of mostly pension money. Today, there are nearly 8,000 mutual funds with $13 trillion in total assets, and 90 million Americans own an average of four mutual funds worth $120,000.

What does all this have to do with the insurance industry?

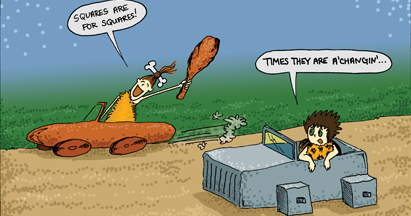

We have a way better wealth-building and retirement income vehicle than a mutual fund. It’s called over-funded permanent insurance, and it includes both the equity-indexed universal life variety as well as the whole life variety. And, while the category has seen substantial growth, it is dwarfed by the growth of Wall Street‘s Mutual Fund industry at approximately the same age.

Why? I believe it’s because we keep insisting we’re in the insurance business, when we’re really in the wealth-building business. We’re not making the public image shift that served Wall Street so well. Here’s what I mean. Put yourself in an average investor’s shoes, and rank the investments and the types of advisors listed below in terms of their relevance to the task of wealth-building.

|

Investment/Security/Instrument |

Advisor Type |

|

Stocks |

Stock Broker |

|

Bonds |

Life Insurance Agent |

|

Mutual Funds |

Fee-Based Planner |

|

Life Insurance |

Barber |

|

Real Estate |

Attorney |

|

Precious Metals |

CPA |

|

CDs |

Registered Investment Advisor |

You know “Life Insurance,” and “Life Insurance Agent” would come in at the bottom of the respective lists by a long shot. We may even come in below the barber (just making sure you’re paying attention).

The point is that neither we, nor our products, have credibility in the eyes of our prospect base when it comes to helping them build wealth. And it’s not because we don’t have great products, great carriers, and great selling skills. It’s because we can’t seem to grasp the simple fact that we have to adapt our approach to the market. Where do we start? Here are some suggestions:

Reconsider What Business you’re In – We’re in the wealth-building/retirement income planning business, not in the insurance business. Insurance may be the product that gets the prospect to that outcome, but it’s just the product. Don’t let it define who you are or what you’re about. Be laser-focused on what you do for people. Help them build wealth.

Develop a Parallel Identity – Carve out a new parallel identity for yourself as a wealth-building expert. Set up a separate website. Carry a separate business card. Have a different elevator pitch. Over-funded permanent insurance is less about the insurance and more about its wealth-building power. Identify it, and yourself, that way.

Learn a New Language – The “language” of over-funded permanent insurance is unique. Resist the urge to use more comfortable words like Life Insurance, Death Benefit, and Illustration until way, way later in the sales conversation. Focus on the outcomes your products deliver regardless of the label that may adorn them. There is a time and place for product, and product language. But it’s not up front.

Polish Your Story – What is the outcome we deliver to our clients, and how can we incorporate that into our new, parallel persona? We help people build wealth that grows without market risk; can be accessed tax-free; that locks in gains so they’re never at risk; and we do so in a way that neutralizes the impact of a lifetime of fees and commissions. Take those points, and develop a story around them that speaks to prospects’ fears and concerns.

Know Thy Product – Know how these products work and how to construct them properly. Communicate the virtues and caveats accurately, and adjust annually as necessary to be sure your client’s contract is performing at maximum efficiency. This product category is not for the timid or the intellectually disengaged. And, poor product knowledge will kill you in the market.

Consider Your Competition – Most of the money you’re trying to pull into your over-funded insurance products is currently being managed by a well-dressed, ivory tower investment advisor working for a big name brokerage. They’ll instantly shed that suit and turn into a rabid hyena when they sense you advising their client to go in a different direction. That’s your competition—not another insurance advisor or insurance product. Hone your story in a way that contrasts you to the mainstream world and establishes your credibility.

Consider Your “Other” Competition –The mainstream information sources that prospects pay attention to are not very “permanent insurance friendly.” In fact, some of them (Dave Ramsey, Suze Orman, Clark Howard) are downright hostile towards our product category. Recognize it, be ready for it, and provide credible alternative information from unbiased sources.

Have Plan “B” at the Ready – Life insurance is still an underwritten product. Not every prospect will qualify. Just be smart. Mr. Uninsurable may still be able to build wealth in an IUL or whole life contract by making the insured a child or grandchild. If that’s not a possibility, an annuity might fit the bill. And even though annuities have only one true benefit over life insurance (the guarantee of lifetime income), be ready to artfully pivot the conversation in order to be of service to your prospect and get a sale.

Empty the Bookshelves – We love our insurance carriers. But dog-gonit, their brochures, pamphlets, slicks, illustrations and other printed material just don’t help us close deals. Be the brochure yourself, and tell the story in a way that will have meaning to your prospect.

Step Up Your Game – We’re competing with the guys and gals from those big Wall Street firms. So, dust off those ties and dresses, meet prospects in your office (not their home), and exude a level of professionalism that we’re not often held to as mere insurance agents.

Be proud of who you are and what you do. There is no product or strategy in the mainstream investing world that can do what our products can do. Act like you have something that’s unique, powerful, and worth shouting from the rooftop before you walk out the door every morning.

If we do our jobs right, someone in the future will be writing an article about how 90 million Americans own over-funded permanent insurance with an average cash value of $120,000 (likely much more) because the insurance industry had an epiphany about who they were and what their products could do for people.

AgenteNews Insurance Producer's Online Resource

AgenteNews Insurance Producer's Online Resource