By Pamela Yip, February 22, 2015 Taxpayers are just starting to learn the complex connection between the Affordable Care Act and taxes. For the first time, taxpayers will have to state whether they had health insurance through an employer, a health insurance exchange or a private insurance policy. If they didn’t, they could face a tax penalty. “I don’t think …

Read More »Enrollment Period for Health Insurance Ends; Now the Tax Penalties Start

By Margot Sanger-Katz, February 17, 2015 The Affordable Care Act’s second open enrollment period ended on Sunday. Well, almost. Some computer problems over the weekend have led the administration to give a one-week extension to people who tried and failed to sign up. But its tax penalty season has just begun. For people who didn’t sign up for coverage last …

Read More »Millions in health coverage gap seek to avoid tax penalty

By Emily Schmall, February 14, 2015 Stephanie Daugherty earns too much from her part-time job at a doctor’s office to qualify for Medicaid, but not enough to comfortably afford one of the health plans for sale through the federally-run insurance exchange that Texas and many states use. So the 26-year-old nursing student and mother paid a $180 tax penalty — …

Read More »Feds to Taxpayers: Did You Get Health Insurance?

By Maggie Fox, January 28th, 2015 Two to 4 percent of taxpayers will end up paying a fine because they didn’t have health insurance last year, federal health officials predicted Wednesday. This is the first year that Americans will have to worry about health insurance at tax time. The 2010 Affordable Care Act requires that just about everyone have health …

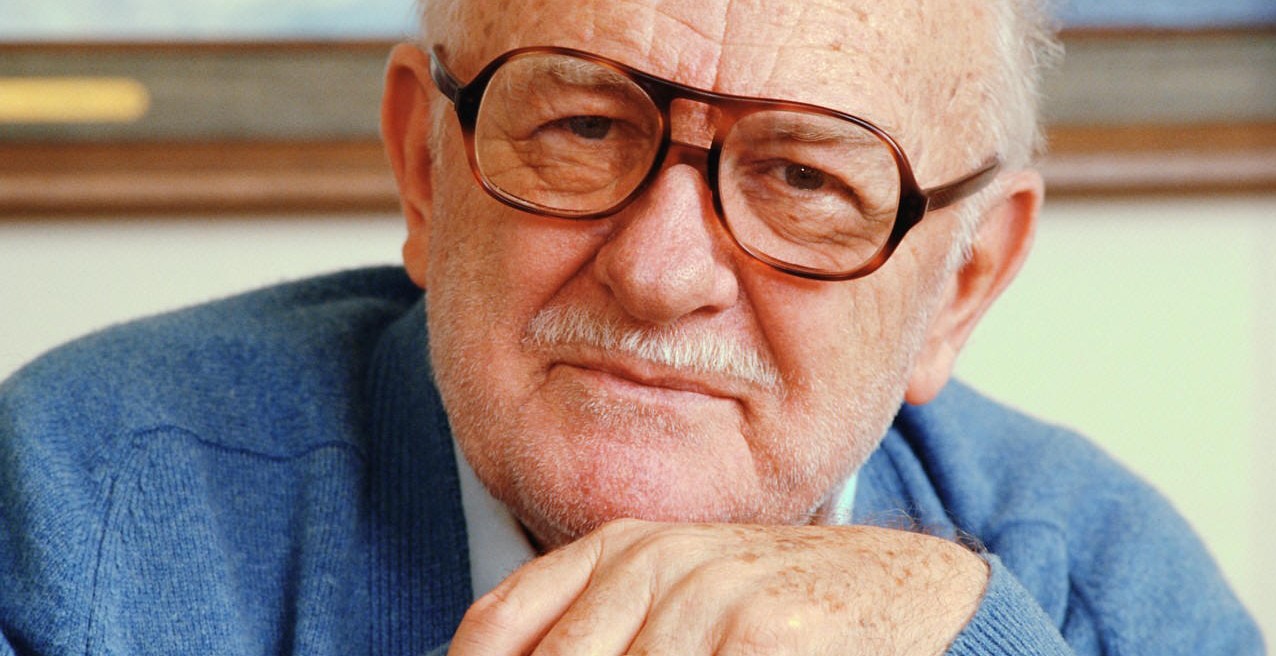

Read More »You’re Never Too Old to Own Life Insurance!

Senior clients often assume they no longer have a need for life insurance. Before they ditch that life insurance plan, it’s important to advise them about the countless benefits life insurance can continue to provide—even in their retirement years. Many clients reach a point in their life when they begin to question the necessity of life insurance. Obviously, their situation …

Read More » AgenteNews Insurance Producer's Online Resource

AgenteNews Insurance Producer's Online Resource