One of the tenets of insurance law is that parties to an insurance policy are expected to deal with each other in utmost good faith. Applicants for insurance, or their brokers, must disclose all relevant underwriting information fully and accurately to prospective insurers. If the application contains any misrepresentation or omits information that could affect the underwriting decision of the …

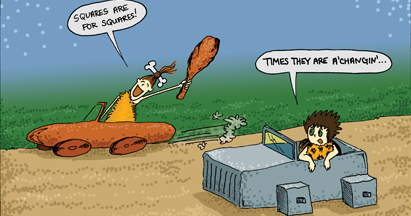

Read More »Adapt or Perish: How the Insurance Industry Is Blowing the Best Opportunity it’s Had in a Generation

In 1974, the Employee Retirement and Income Security Act (ERISA) became law and ushered in the tax-qualified savings plan (also known as the IRA, 401(k), Keogh, and others). Almost overnight, Wall Street advisors lost their biggest and best clients—pension fund managers and workers were cast into the unknown world of managing their own investment accounts. Wall Street shifted its model …

Read More »Are You Ready for the Toughest Questions Every Financial Advisor Is Asked?

As your plane taxis down the runway, the person beside you strikes up a conversation. The what-do-you-do-for-a-living question will usually come up. When it does, you know that they will inevitably follow it up with another question—perhaps something like: “My brother-in-law is really into gold stocks. Do you have any hot tips?” Many professions have these dreaded questions. In social …

Read More »Important Checklist When Faced with a Death

Losing a loved one is arguably one of the most difficult experiences in life. In addition to coping with the grief and loss of a loved one, there are also a variety of challenging tasks and important financial decisions to be completed, some of which include: Making final arrangements. Reviewing funeral costs and funding options. Settling an individual’s estate and …

Read More »Whole Life Plans: Arguably the Best Kept Secret for College Savings Plans

As college costs continue to rise, having a college degree is more important than ever. According to studies by the College Board in 2011, those with college degrees earn 74% more than high school graduates, experience higher job satisfaction and have lower unemployment. For parents like me, college tuition costs can be sizeable. In the same aforementioned study, the cost …

Read More »10 Reasons Annuities Make Sense for a Portion of a Retirement Plan

With life expectancies greater than ever, retirement could very likely be the longest phase of our clients’ lives. Therefore, it is absolutely imperative for retirees to have a plan in place that: Provides the ability to spend and enjoy their money in retirement Protects them from “living too long” and outliving their income Since retirement income planning is an extremely …

Read More »Life Settlements: Hidden Money in an Old Suit Pocket

A former Harvard professor, feeling the squeeze of medical bills for his aging mother-in-law, recently sold his life insurance policy—and was happy to do it. “Found money” was the refrain. Shrinking retirement savings, longer life expectancies and slow economy are driving more seniors to life insurance settlements, and they are finding a more sophisticated marketplace receptive to their financial needs. …

Read More »The Buy and Hold Strategy Is a Sound Investment Strategy, Right?

One of the most common and recommended investment strategies is called “buy and hold.” According to TIAA-CREF, “This strategy calls for accumulating stocks and keeping them for a number of years, regardless of the overall market conditions or activity.” One of the strongest arguments for the buy and hold strategy is the efficient market hypothesis (EMH), which basically says that …

Read More »Mortgage Protection Plans: An Excellent Way to Keep Families in Their Homes

How do you think most people would answer the following question: “If you were to unexpectedly die, become seriously ill or get disabled, would you and/or your family suffer financially?” Since most almost always answer, “Yes,” think about this next question: “Would that bother you? Especially if it meant that you and/or your family could no longer afford to stay …

Read More »A Step-by-Step Guide to Launching and Elevating Your Career as a Financial Advisor

The career of a financial advisor is full of challenges and opportunities. Dealing with those constant challenges and relentlessly chasing down those opportunities can be tiring, even on the best days, and can stop your business cold on the worst days. How do you navigate the highs and lows of your business and create a career that grows with you? …

Read More » AgenteNews Insurance Producer's Online Resource

AgenteNews Insurance Producer's Online Resource