On Friday, February 15, 2013, CMS (Centers for Medicare and Medicaid Services) released the 2014 Medicare Part D deductibles and co-insurance limits for 2014. This was a part of their “2014 Advance Call Letter” which gives Medicare Advantage Plans and Medicare Part D plans advance notice of funding for calendar year 2014 so that they can start formulating their bids for the following year. The final notice will be published by CMS on April 1, 2013.

In a very unusual situation, the Medicare Part D deductibles and co-insurance limits actually declined in 2014 versus 2013. The Medicare Part D deductible will fall from $325 to $310. The initial coverage limit will decline from $2,970 in 2013 to $2,830 in 2014. The initial coverage limit is the total negotiated value of prescription drug costs (both the insurance company portion and the Medicare beneficiary’s cost share) before the Medicare beneficiary reaches the “doughnut hole,” or coverage gap.

The out-of-pocket threshold decreased from $4,750 in 2013 to $4,550 in 2014. The out-of-pocket threshold is the amount of cost sharing borne by the Medicare beneficiary before they leave the coverage gap and enter the “catastrophic coverage” portion of the Medicare Part D benefit. The out-of-pocket threshold includes the following costs: 1) the deductible; 2) cost sharing while in the initial coverage limit; and 3) cost sharing while in the coverage gap. Additionally, the portion of prescription drug cost borne by the pharmaceutical companies for brand name prescription drugs in the coverage gap (this is sometimes called the Part D rebate) is also included in the out-of-pocket threshold.

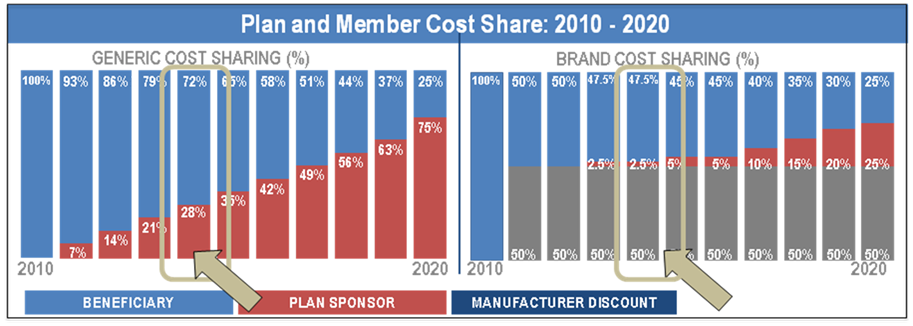

Due to the provisions of the Affordable Care Act (ACA), Medicare beneficiaries will continue to pay lesser and lesser amounts for both their brand name and generic prescription drugs. Ultimately, by 2020, the entire coverage gap will be eliminated; however, this is being phased in during the period from 2010 through 2019. For example, in 2013, Medicare beneficiaries will pay 47.5% of brand name drugs and 79% of the cost of generic drugs. The “rebate” is 50% of the cost of brand name drugs, so the insurance company actually pays 2.5% of brand name drugs and 21% of generics in the coverage gap. In 2014, Medicare beneficiaries will continue to pay 47.5% for brand name drugs (50% covered by rebate and 2.5% by the insurance company), but the cost sharing for generic drugs will drop from 79% to 72%.

The following graph illustrates the changes in plan and member cost share from 2010 through 2020 with 2014 highlighted.

Finally, once the Medicare beneficiary reaches the out-of-pocket threshold and into the “catastrophic coverage,” they will see the minimum copay decline as well. The minimum copay for generics will decline from $2.65 copay to $2.55 copay in 2014. For brand name drugs, the minimum copay will decline from $6.60 copay to $6.35 copay in 2014. The Medicare beneficiary will pay either 5% of the negotiated cost of the drug or the minimum copays listed above, whichever is greater.

On April 1, 2014, CMS will finalize these dollar amounts; however, it is unlikely that they will deviate by very much.

AgenteNews Insurance Producer's Online Resource

AgenteNews Insurance Producer's Online Resource